The GOP-controlled Senate passed their version of the tax bill over the weekend which moved the bill to the Joint Conference Committee where the House and Senate bills will be reconciled. This blog post will identify the main provisions on which the House and Senate tax bills agree and will sort out any differences in the details of each. In addition, we’ll highlight two tax issues addressed by the Senate alone.

Comparing the House and Senate Tax Bills

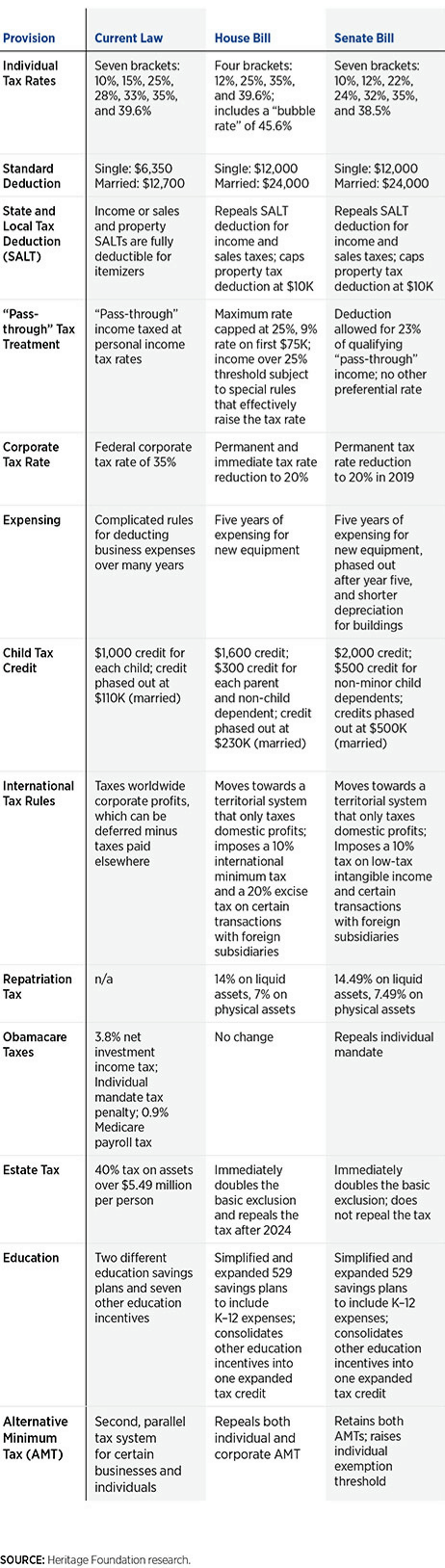

There is much commonality between the two bills, especially on the business side. Both House and Senate bills agree to allow businesses to fully write off the purchase of new equipment for the next five years. Currently, the bills agree on a lower C-corporation tax rate of 20% but disagree on the timing of its implementation. The House bill has this tax cut going into effect in 2018, but the Senate’s version waits until 2019 for implementation. Both bills also have “pass-through” income taxed at lower rates but differ on how this tax will be calculated.

One of the major changes on the individual tax front in both bills is the repeal of the state and local tax deduction and capping the property tax deduction at $10,000. As we predicted in last week’s blog, the Senate modified their previous proposal to allow a $10,000 property tax deduction to match the House’s version. The Senate has also adopted the House’s proposal to double the standard deduction for individuals and married couples. The Senate bill maintains the current deductibility of home mortgage interest on up to $1,000,000 of loans for the primary and secondary home (vacation home) while the House bill limits the mortgage interest deduction for mortgage debt of up to $500,000 and only on the primary residence. The House bill eliminates any medical deduction while the Senate bill allows a medical deduction for expenses in excess of 7.5% of your adjusted gross income (AGI) for years 2017 and 2018 and expenses in excess of 10% of your AGI for years after 2018. Finally, in both House and Senate versions, estate tax exclusion will double, allowing $11,000,000 to be inherited tax-free. However, the House bill fully repeals the estate tax after 2024.

Some items received attention from the Senate but not from the House. An amendment added to the Senate bill would allow families to use 529 savings plans, originally intended for college savings, for K-12 education, including private school and homeschooling. The Senate bill also repealed Obamacare's individual healthcare mandate which required everyone to have health insurance or pay an additional tax.

One stark difference between the House and Senate versions of the tax bill is that the House bill eliminated the alternative minimum tax (AMT) for both corporations and individuals. The Senate bill maintained it. The decision to eliminate AMT will be less significant because many deductions that previously triggered AMT (including state income taxes) are being eliminated.

The reconciliation phase should be interesting as Congress attempts to minimize the overall cost of the bill without impacting projected growth to the economy, as discussed in our previous blogs.

Key provisions to watch are as follows:

- Mortgage interest deduction limitation on mortgage debt

- House limits to $500,000; Senate limits to $1,000,000

- Top corporate tax rate

- Could the agreed rate of 20% increase to 22% to help defray the cost of the bill?

- Also, what year will the tax rate go into effect?

- Use of 529 savings for K-12 education

- Could this issue become a political firestorm on the education front?

- Repeal of the individual health care mandate

- Deductibility of medical costs

- Repeal of AMT

Congress also must vote to fund the government before the end of 2017, which may have an impact on the tax bill negotiations. We will be seeing a lot of activity as Congress hopes to finalize the tax bill prior to the Christmas break.

Subscribe below to receive emails with our continuing discussion of the tax law changes. As more details come out, we’ll share our tax and financial strategies to assist with building your wealth.

Want to stay informed about the proposed tax reform?

Enter your email below and we'll keep you updated!

Comments 1

Thanks for keeping me up to speed !!

Waiting for you’re next update