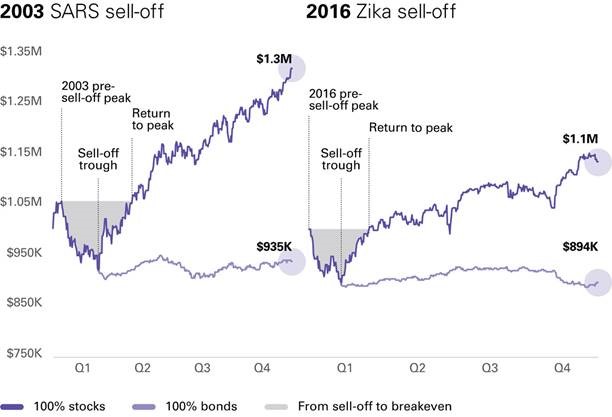

As you know, stock market drops and bouts of volatility aren't rare events—even those that grow out of health crises such as the SARS (severe acute respiratory syndrome) outbreak in 2003 and the Zika virus outbreak in 2016. The key to getting through such turbulent times is understanding that these market conditions don't last forever (see the figure below) and that markets can recover more quickly than you might think.

Source: Calculations based on data from FactSet.

Volatility is back

Just as many people were starting to think markets only move in one direction again, the pendulum has swung the other way. Anxiety is a completely natural response to these events. Acting on those emotions, though, can end up doing us more harm than good.

There are several reasonable assumptions about why markets have become more volatile. Among the issues frequently splashed across newspaper front pages: global growth fears, policy uncertainty, geopolitical risk, and now the Coronavirus. In many cases, these issues are not new. Markets do not move in one direction. If they did, there would be no return from investing in stocks and bonds. And if volatility remained low forever, there would probably be more reason to worry.

For those still anxious, here are five simple truths to help you live with stock market volatility:

1. Don’t make presumptions

Remember that markets are unpredictable and do not always react the way the experts predict they will. When central banks relaxed monetary policy during the crisis of 2008-09, many analysts warned of an inflation breakout. If anything, the reverse has been the case with central banks fretting about deflation.

2. Someone is buying

Quitting the equity market when prices are falling is like running away from a sale. While prices have been discounted to reflect higher risk, that’s another way of saying expected returns are higher. And while the media headlines proclaim that “investors are dumping stocks,” remember someone is buying them. Those people are often the long-term investors.

3. Market timing is hard

Recoveries can come just as quickly and just as violently as the prior correction. For instance, in March 2009—when market sentiment was at its worst—the S&P 500 turned and put in seven consecutive months of gains totaling almost 80%. This is a reminder of the dangers for long-term investors of turning paper losses into real ones and paying for the risk without waiting around for the recovery.

4. Never forget the power of diversification

While equity markets have turned rocky again, highly rated government bonds have flourished. This helps limit the damage to balanced fund investors. So diversification spreads risk and can lessen the bumps in the road.

5. Discipline is rewarded

The market volatility is worrisome, no doubt. But through discipline, diversification, and understanding how markets work, the ride can be made bearable. At some point, value re-emerges, risk appetites reawaken, and for those who acknowledged their emotions without acting on them, relief replaces anxiety.

*Adapted from “Living with Volatility, Again” by Jim Parker, Outside the Flags column on Dimensional’s website, October 2014. Dimensional Fund Advisors LP ("Dimensional") is an investment advisor registered with the Securities and Exchange Commission. Diversification does not eliminate the risk of market loss. There is no guarantee investment strategies will be successful. The S&P 500 Index is not available for direct investment and does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. This content is provided for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Want to RECEIVE COVID-19 UPDATES?

Enter your email below and we'll keep you updated!