I bet all of us, one time or another, have made a wish and gotten what we’ve wanted, only to realize the reality falls short of the expectation.

The origin of this saying is Aesop’s Fables. According to the World History Encyclopedia,1 they were written by a former Greek slave, in the late to mid-6th century BC. Aesop's Fables are the world's best-known collection of morality tales. The fables, numbering 725, were originally told from person-to-person as much for entertainment purposes but largely as a means for relaying or teaching a moral or lesson.

Equity investors have been wishing for the Federal Reserve to begin a round of interest rate cuts since the start of 2022. Five separate times since March 2022 the market has rallied on the slightest hint of coming rate declines and accommodative monetary policy, only to be disappointed and reverse downward when economic data doesn’t provide the catalyst and the Fed says “No”.

However, the latest economic and inflation data show some pretty clear signs of weakness, and the latest comments by Federal Reserve Chairman Jerome Powell in his testimony before Congress have many market pundits postulating this time might be different. In his appearance on the Hill, he pointed to “a cooling labor market” and suggested “further softening might be welcome”. 2 Following those comments, the equity markets bolted to new highs in anticipation of coming rate declines. In fact, as of this writing, futures indicate a 93% probability of a 25 basis point (1 basis point is equal to 1/100th of a percentage point) reduction in the Fed Funds Rate in the next meeting of the Federal Reserve in September.3

The underlying rationale for the equity market to rally at the mere suggestion of declining interest rates is the belief that lower rates will boost the demand for equities as yields on equity alternative investments and short-term cash reserves decline. This belief has proven to be largely accurate since the Fed’s active management of the level of interest rates has increased following the collapse of the housing bubble in 2008.

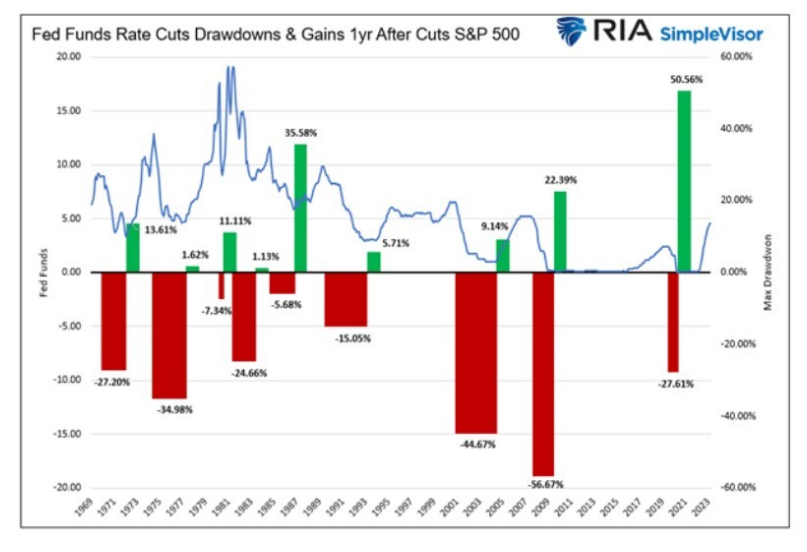

However, as is often the case, the devil is in the details. Looking at data going back to 1970, the best equity market performance has been following the final rate cut of the Federal Reserve rate cutting cycle (see chart below). As you can see, during virtually every rate cutting period by the Fed, the equity market weakened as the Fed began implementing its rate cutting policy and then rallied strongly following the end of the rate cuts.4

Thinking about the possible reasons the impact interest rate movements by the Fed may have on equity market movements, it seems logical since rate cuts typically are instituted to counter a deflationary cycle or negative financial event. Such a negative environment can lead to a slowdown in consumer activity, which feeds into lower corporate earnings, forcing the markets to reprice future valuation expectations.

It's possible this time will actually be different and the driving factors leading to a Fed rate cutting cycle will not have the typical negative impact on equity market values during the rate cutting cycle. But that outcome requires a pretty significant deviation from historical experience.

Footnotes: