The $1.2 trillion Infrastructure Investment and Jobs Act signed into law by President Biden contains a provision effectively ending the Employee Retention Credit, also known as the Employee Retention Tax …

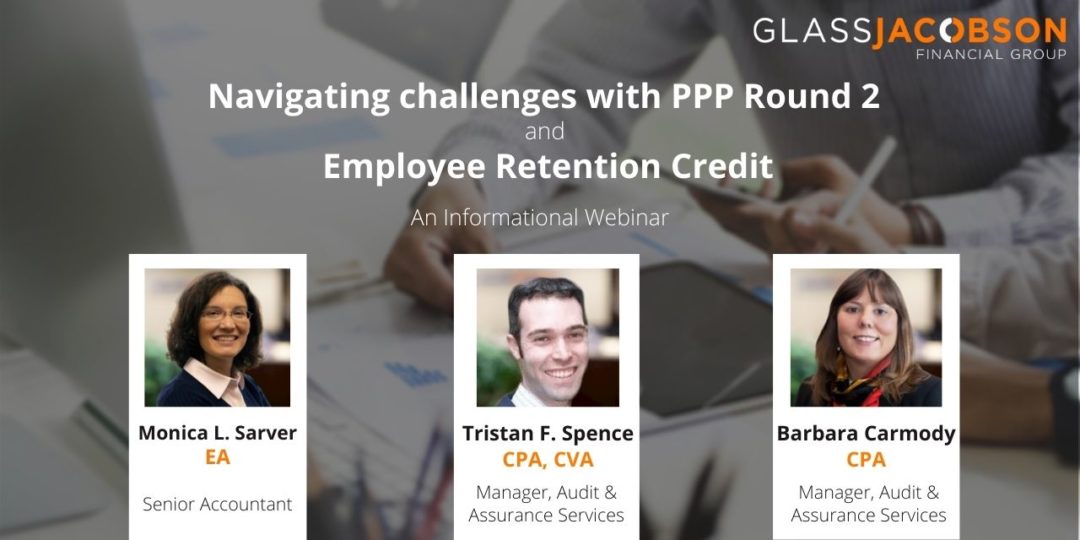

Navigating Challenges With PPP Round 2 and Employee Retention Credit

Join this informational webinar to learn about the second round of Payroll Protection Program, the Employee Retention Credits, and how these could affect your business.

Maryland Accesses Rainy Day Fund for $250 Million of New Economic Relief

The state of Maryland is dipping into its Rainy Day Fund to add $250 million to the state’s emergency economic relief efforts for small businesses. The additional relief adds to …

New SBA Guidance Clears the Way for a Simpler PPP Loan Forgiveness Process

On August 11, when we last wrote about the Personal Paycheck Flexibility Act, the window for PPP loan forgiveness applications had just started to open. But, as we indicated at the …

As the PPP Forgiveness Window Opens Businesses Should Wait-and-See

The week of August 12 marked the first week that the Small Business Administration would be accepting applications for PPP loan forgiveness. But businesses are being advised not to jump …

Republican Senators Propose Version of New CARES Act

After a couple of weeks of intra-party squabbling, Senate Republicans released the details of it proposed coronavirus aid sequel. It now faces a stonewall of Democrats who passed their own …