The $1.2 trillion Infrastructure Investment and Jobs Act signed into law by President Biden contains a provision effectively ending the Employee Retention Credit, also known as the Employee Retention Tax …

Maryland state income tax filing deadline has been extended to July 15 due to COVID-related changes to tax code

Maryland residents now have three extra months to file state income taxes this year because of Coronavirus pandemic-related changes to the tax code.

Employee Retention Tax Credit Covers More Businesses and Wages Under the Consolidated Appropriations Act, 2021

The Consolidated Appropriations Act, 2021 (the Act), signed into law on Dec 27, 2020, extends and enhances several aspects of the employee retention tax credit initially enacted under the CARES Act in 2020.

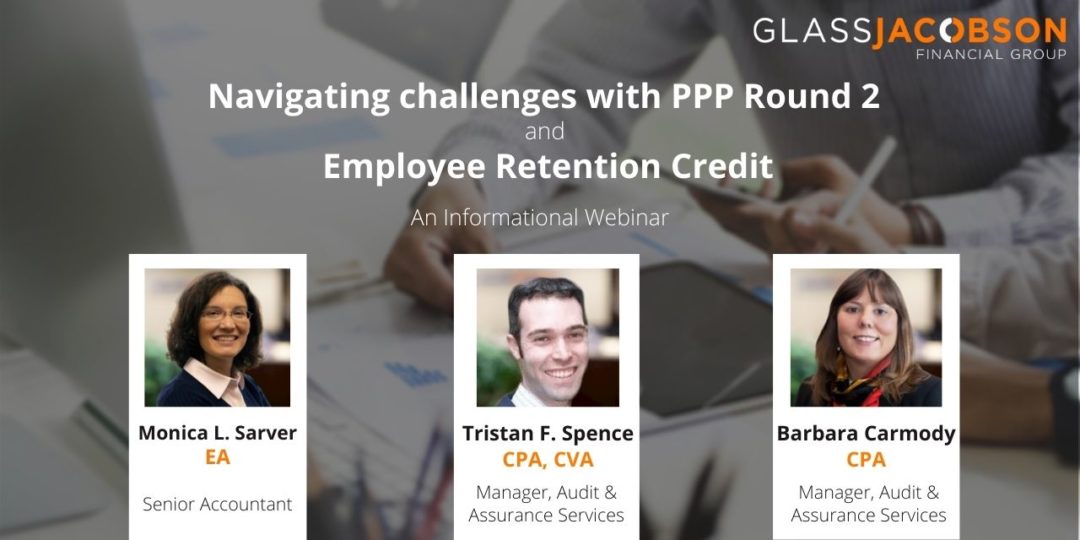

Navigating Challenges With PPP Round 2 and Employee Retention Credit

Join this informational webinar to learn about the second round of Payroll Protection Program, the Employee Retention Credits, and how these could affect your business.

State Tax Filing Deadlines Pushed Back by MD Comptroller

The Comptroller of Maryland has announced a new extension for filing and paying taxes and quarterly estimates.

IRS Issues Form 1099-NEC for Reporting 2020 Nonemployee Compensation

Starting with the 2020 tax year, business taxpayers must report nonemployee compensation of more than $600 on new Form 1099-NEC instead of Form 1099-MISC.