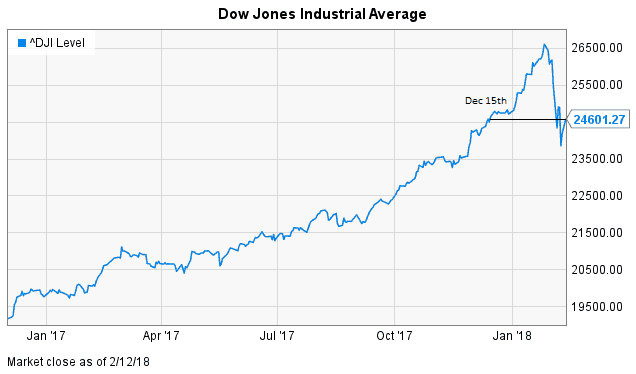

Though last week may have been unnerving for many, the dramatic changes in stock values were not unexpected.

- The significant declines were orderly and only the past few weeks’ gains were lost.

- Rising bond yields may be the cause of investor angst as inflation hawks once again sound the alarm for rising prices and wage growth.

- We anticipate that strong corporate earnings will continue to be reported. With nearly half of S&P 500 companies reporting, over 80% have exceeded estimated earnings. Remember, corporate earnings drive stock growth and our economy.

- Bond yields are likely to continue rising through 2018, benefiting savers who rely on interest-paying investments.

- Political wrangling between the parties continues to upset investors and may cause short term aberrations in value.

- We expect market volatility to continue throughout the year, but long term fundamentals are strong for driving further growth in portfolio values.

OUR BEST ADVICE: Stick with your investment plan and stay globally diversified. We have structured your portfolio in this manner and believe it to be your best defense against uncertainty. Ultimately, this should maximize your long term results.

I hope you found this helpful! Please comment below with any questions or feedback. Learn more about how we help our clients build wealth at glassjacobson.com/investment-advisory.

WANT FUTURE ECONOMIC UPDATES LIKE THIS IN?

Enter your email below and we'll keep you updated!

Comments 1

Thanks for sharing analysis on the bond market.