Informed investors closely monitor the Conference Board’s Consumer Confidence Index because it serves as a reliable barometer of consumer sentiment and future spending behavior. Since consumer spending accounts for a significant portion of economic activity in the United States – nearly 2/3 of GDP – shifts in consumer confidence can signal broader economic trends. A rising index suggests that consumers feel optimistic about their financial situation and the economy, which often leads to increased spending on goods and services. This uptick in consumer activity can benefit sectors such as retail, travel, and real estate, offering investors opportunities for strategic allocation.

Conversely, a decline in consumer confidence may indicate economic uncertainty, job market concerns, or inflationary pressures, potentially foreshadowing a slowdown in consumer spending. For investors, this could mean reevaluating positions in cyclical industries and seeking refuge in more defensive assets. Additionally, the index can influence market sentiment and monetary policy expectations.

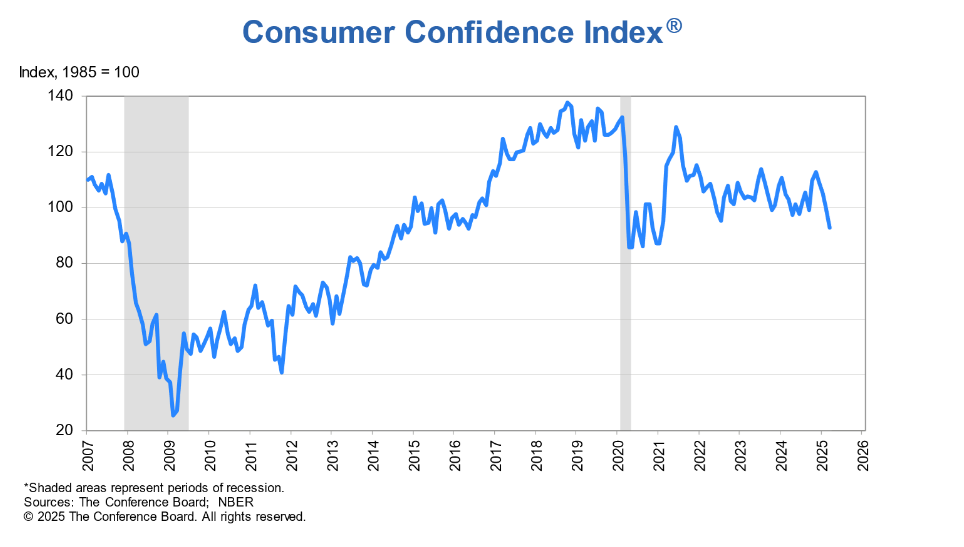

Consumer Confidence Drops in March

In March, the Conference Board Consumer Confidence Index declined by 7.2 points to 92.9 (1985=100). The Present Situation Index, which reflects consumers’ views on current business and labor market conditions, slipped 3.6 points to 134.5. Meanwhile, the Expectations Index – measuring consumers’ short-term outlook for income, business, and employment – fell sharply by 9.6 points to 65.2. This marks the lowest reading for the Expectations Index in 12 years and places it well below the recession-indicating threshold of 80.

“Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022. Of the Index’s five components, only consumers’ assessment of present labor market conditions improved, albeit slightly.

Views of current business conditions weakened to close to neutral. Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low. Meanwhile, consumers’ optimism about future income – which had held up quite strongly in the past few months – largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations.”

Present Situation

Consumers’ assessments of current business conditions were significantly less positive in March.

- 17.7% of consumers said business conditions were “good,” down from 19.1% in February.

- 16.6% said business conditions were “bad,” up from 14.8%.

Consumers’ views of the labor market improved slightly in March.

- 33.6% of consumers said jobs were “plentiful,” unchanged from February.

- 15.7% of consumers said jobs were “hard to get,” down from 16.0%.

More Data Later in the Week

More economic data will be released later this week, including Durable Goods Orders and MBA Mortgage Applications on Wednesday; GDP and Retail Inventories on Thursday; and Consumer Sentiment on Friday.

At Glass Jacobson Wealth Advisors, we continue to monitor the markets closely and ensure that your financial plan remains aligned with your objectives. If you have any questions or would like to discuss your investment strategy, feel free to set a time to talk with our advisors.