Key Takeaways

- The 2nd quarter economic surge encourages a full recovery to pre-pandemic GDP by end of 2021.

- The robust economic recovery belies difficulties in the labor market as jobs and unemployment both rise above expectations.

- Pent-up demand is driving inflation higher, which is certain to test the Fed's rate targeting policy.

- As the Fed signals two rate hikes in 2023, shorter duration fixed income is still preferred until long-term rates resume their ascent.

- International stocks have the potential for stronger returns as global economies reopen and vaccination rates increase.

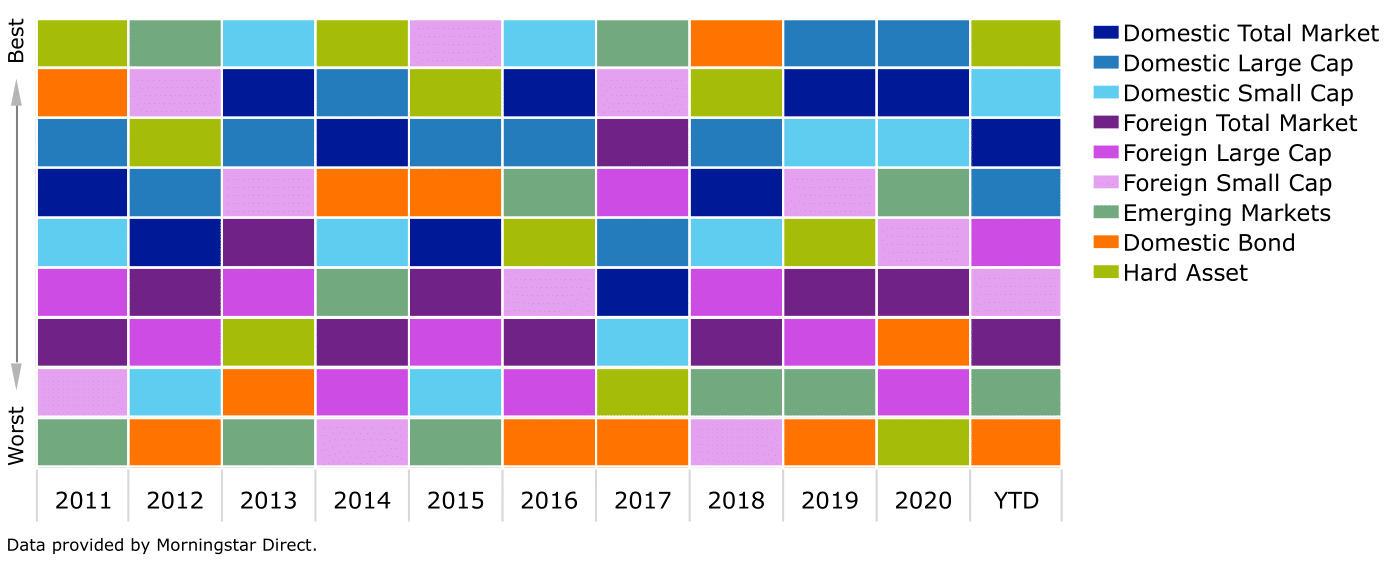

Performance By Asset Class

US economy surges 2nd quarter, expected to have fully recovered pre-pandemic GDP.

As the US economy surges, pace of growth may begin to fade yet remain strong.

- Following last year's collapse in the second quarter, economic growth accelerated in the third quarter of 2020, moderated over the winter, and has now reaccelerated, tracking above 10% annualized real GDP growth for the second quarter this year.

- Blockbuster consumer spending on goods and services, along with rebounding investment spending, could push real economic growth up to 7.5% by year end.

- Pace of real economic growth expected to fade over the course of the year into 2022; return to similar levels toward the end of the last long expansion of roughly 2%.

Economic growth mirrored by acceleration in labor markets as economy reopens.

While previous jobs reports have come shy of expectations, the US added 850,000 jobs in June far exceeding estimates of around 700,000. However, the unemployment rate unexpectedly rose to 5.9% versus estimates of 5.6%, up from 5.8% in May.

- Business reports suggest the labor market may be tighter than these figures suggest as businesses grapple to keep up with a torrent of pent-up consumer demand across all sectors of the economy.

- This mismatch of record high job vacancies and elevated unemployment highlights the shortcoming in job creation is really an issue of labor supply.

- The most robust job growth numbers of the recovery are expected to emerge in the third quarter as virus fears abate, child-care difficulties ease, and supplemental unemployment insurance expires in most states.

- This should allow the unemployment rate to fall below 5% by the end of 2021 and between 3.5% to 4% by the end of 2022.

Strengthening demand boosts inflation; Federal Reserve target policy to be tested.

Inflation figures have risen sharply recently in the US. This is a function of strengthening demand for goods and services as vaccination rates increase and the economy more fully reopens.

- The Consumer Price Index (CPI) rose by 4.9% year-over-year in May. While certainly above average, the increase is amplified by declines in prices a year prior.

- The CPI in May 2020 was merely 0.2% higher than in May 2019, marking near zero inflation over the 12-month period. However, the total annualized year-over-2-year increase of 2.5% confirms modestly rising inflation.

- Meanwhile, after years of dormant inflation, bubbling inflation from a powerful economic rebound coupled with rising wages could put the Fed's new framework to the test.

- Consequently, expect inflation to climb above 3.0% by the end of 2021 and stay close to this place into 2022.

Federal Reserve foresees timing of its first post-pandemic rate hike in 2023.

At its June meeting, the Fed delivered meaningful forward guidance by way of its updated interest rate and economic projections. Real GDP was upgraded from 6.5% to 7.0% and headline inflation forecasts increased to 3.0%-3.4% by the end of this year.

- Along with its more optimistic outlook on the economy, the committee shifted to a slightly more hawkish stance. The median dot plot for June reflects two rate hikes in 2023, up from the no rate hikes in March, and the Fed is now actively discussing a timetable for tapering its massive bond purchases.

- There continues to be a place in portfolios for fixed income to provide diversification and protection in the case of an equity market or economic relapse.

- However, these technical factors suppressing long-term interest rates will not last forever, and fixed income investors may want to focus on shorter duration bonds to be well positioned for when long-term rates resume their ascent.

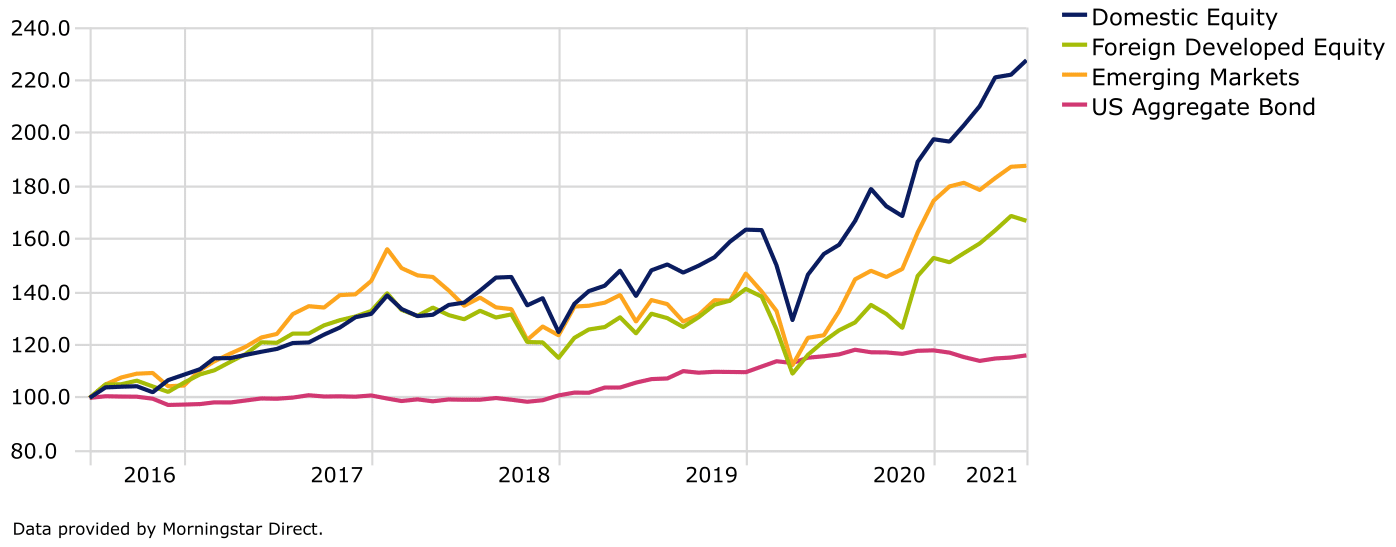

5-Year Global Market Performance

Synchronized global recovery delayed; International vaccination progress accelerates.

While US stocks have remained range bound as earnings catch-up to elevated US valuation multiples, both Emerging Market and Developed Country stocks outside the Unites States are selling at some of their cheapest levels relative to their US counterparts in the last 20 years.

- International equities also offer greater sensitivity to the powerful post-pandemic economic rebound, particularly Europe and Japan where cyclical sectors make up 55% and 56% of their respective equity markets.

- Lower trade tensions and the prospect of a softening dollar both argue for a greater allocation to international equity

Important Notes

- Investors should carefully consider the investment objectives and risks as well as charges and expenses before investing.

- Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable but should not be assumed to be accurate or complete. The views and strategies described may not be suitable for all investors.

- Performance data is provided by Morningstar Direct.

- Asset class performance represented as follows: Domestic Total Market (Russell 3000 TR); Domestic Large Cap (Russell 1000 TR); Domestic Small Cap (Russell 2000 TR); Foreign Total Market (MSCI World ex USA NR); Foreign Large Cap (MSCI World ex USA Large NR); Foreign Small Cap (MSCI World ex USA Small Cap NR); Emerging Markets (MSCI EM NR); Domestic Bond (BBgBarc US Agg Bond TR); Hard Asset (DJ US Select REIT TR)

- Global market performance represented as follows: Domestic Equity (Russell 3000 TR); Foreign Developed Equity (MSCI World ex USA All Cap); Emerging Markets (MSCI EM); US Aggregate Bond (BBgBarc Us Agg Bond TR);